|

市場調查報告書

商品編碼

1432779

防鏽塗料:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Anti-Corrosion Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

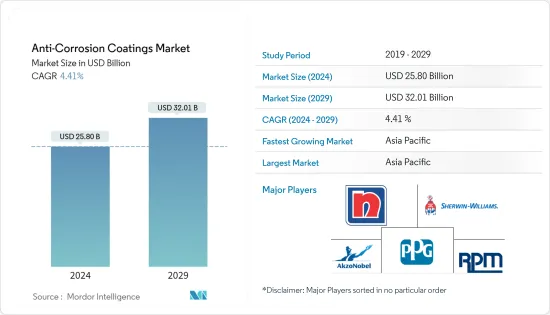

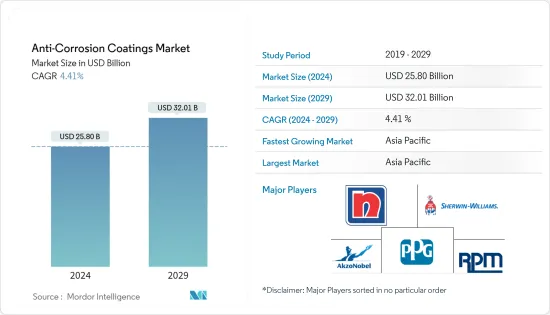

2024年防鏽塗料市場規模估計為258億美元,預計到2029年將達到320.1億美元,在預測期間(2024~2029年)以4.41%的複合年增長率增長。

主要亮點

- COVID-19大流行對防鏽塗料行業產生了負面影響。由於全球封鎖和各國政府實施的嚴格監管,大多數生產基地被關閉,造成毀滅性打擊。儘管如此,業務自 2021 年以來已經復甦,預計未來幾年將大幅成長。

- 推動市場的主要因素是基礎設施產業的顯著成長、海洋產業需求的增加以及亞太和北美地區石油和天然氣活動的擴大。

- 與揮發性有機化合物(VOC)相關的法規預計將阻礙所研究市場的成長。

- 新興經濟體對基礎設施產業的大量投資以及水性塗料的日益普及預計將為未來防腐蝕塗料市場提供巨大的成長機會。

- 由於在預測期內該地區各個最終用戶行業的投資不斷增加,預計亞太地區將主導防鏽塗料市場。

防鏽塗料市場趨勢

基礎建設產業需求增加

- 基礎設施領域佔據市場最大佔有率,預計也是成長最快的領域。鐵路、橋樑和公路是基礎設施的主要部分。人口的快速成長和基礎設施計劃的成長預計將增加對防鏽塗料的需求。

- 亞太地區和北美有各種較小的計劃。中國不僅是世界上人口最多的國家,也是鐵路旅客數量最多的國家。

- 此外,亞太地區的道路計劃預計防鏽塗料的消費量也會增加。例如,據道路運輸和公路部稱,正在進行的 Bharatmala Pariyojna 正在開發一條長約 26,000 公里的經濟走廊,透過公路承擔大部分貨運。實施經濟走廊、青青走廊、南北東西向走廊建設,興建中間走廊8000公里、支線7500公里。

- 據China Briefings報導,截至2021年底,中國財政部在2022年第一季度使用的分配額度中預分配了2296億美元,希望額外的流動性能夠推動基礎設施建設的投資。 今年年初,更多的撥款被分配給資本需求高的州和地區。

- 2023年4月,根據世界銀行資料,私人參與基礎建設(PPI)約263個計劃,金額約917億美元,較2021年成長23%。低收入和中等收入國家也出現了這種情況,這些國家的基礎設施投資於 2022 年恢復。

- 根據美國交通部 (USDoT) 和聯邦公路管理局 (FHWA) 的數據,從 2022 年到 2030 年,將撥出約 1200 億美元用於公路和橋樑,其中約 2,800 座橋樑已經開通。 美國交通部已向 166 個項目投資 22 億美元,用於通過可持續性和公平重組美國基礎設施 (RAISE) 贈款。 這將促進鐵路、港口、公路、橋樑和多式聯運的現代化,使其更實惠、更安全和更可持續。

- 由於上述因素,預計在預測期內防鏽塗料的需求將會增加。

亞太地區主導市場

- 在亞太地區,中國、日本和韓國在造船業方面處於領先地位,但越南、印度和菲律賓也正在興起新的航運樞紐。

- 澳洲和紐西蘭都是島國,澳洲海岸線和水道的地理面積允許容納大量的休閒、商業和國防船隻。

- 中國是世界主要石油出口國之一。因此,影響石油和天然氣產業擴張活動的變化可能會對中國防鏽塗料市場產生重大影響。

- 據美國能源情報署稱,中國將在2022年優先考慮低碳和碳中和,分別實現2030年和2060年碳排放和碳中和的氣候目標。該計畫設定的目標是將天然氣年產量提高到 8.1 兆立方英尺 (Tcf),並將發電裝置容量提高到 3.0兆瓦(TW)。

- 防腐蝕塗料在基礎設施應用和全球發展中也發揮著重要作用,基礎設施投資的增加增加了對防鏽塗料的需求。根據亞洲開發銀行(ADB)的數據,如果亞太地區需要保持成長勢頭、應對氣候變遷和消除貧困,到2030年該地區每年需要花費1.7兆美元用於基礎設施發展。你需要投資。

- 因此,預計上述因素將在預測期內推動防鏽塗料市場。

防鏽塗料產業概況

防鏽塗料市場已整合,主要企業包括 PPG Industries, Inc.、Akzo Nobel NV、Nippon Paint Holdings、RPM International Inc. 和 Sherwin-Williams Company。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 基礎設施產業顯著成長

- 海洋工業需求增加

- 擴大亞太和北美的石油和天然氣活動

- 抑制因素

- 與揮發性有機化合物 (VOC) 相關的政府法規

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模:金額)

- 依樹脂類型

- 環氧樹脂

- 醇酸

- 聚酯纖維

- 聚氨酯

- 乙烯基酯

- 其他樹脂類型

- 依技術

- 水系統

- 溶劑型

- 粉末

- UV固化型

- 依最終用戶產業

- 油和氣

- 海洋

- 電力

- 基礎設施

- 產業

- 航太/國防

- 運輸

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率分析/排名分析

- 主要企業策略

- 公司簡介

- Akzo Nobel NV

- Axalta Coating Systems, LLC

- BASF SE

- HB Fuller Company

- Hempel A/S

- Jotun

- Kansai Paint Co.,Ltd

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- Sika AG

- The Sherwin-Williams Company

第7章 市場機會及未來趨勢

- 新興國家基礎建設產業大規模投資

- 水性塗料的採用增加

簡介目錄

Product Code: 52574

The Anti-Corrosion Coatings Market size is estimated at USD 25.80 billion in 2024, and is expected to reach USD 32.01 billion by 2029, growing at a CAGR of 4.41% during the forecast period (2024-2029).

Key Highlights

- The COVID-19 pandemic had a negative impact on the anti-corrosion coatings sector. Global lockdowns and severe rules enforced by governments resulted in a catastrophic setback as most production hubs were shut down. Nonetheless, the business has been recovering since 2021 and is expected to rise significantly in the coming years.

- Major factors driving the market are significant growth in the infrastructure industry, an increase in demand from the marine industry, and expansion of oil and gas activities in Asia-Pacific and North America.

- Regulations related to volatile organic compounds (VOCs) and is expected to hinder the growth of the market studied.

- Significant investments in the infrastructure industry in emerging economies and increased adoption of water-borne coatings are expected to provide remarkable growth opportunities in the anti-corrosion coatings market in the future.

- Asia-Pacific region is expected to dominate the anti-corrosion coatings markets due to the increase in investments in various end-user industries in the region during the forecast period.

Anti-Corrosion Coatings Market Trends

Increasing Demand from the Infrastructure Industry

- The infrastructure segment accounts for the largest share of the market and is also estimated to be the fastest-growing segment. Rails, bridges, and roads contributed as the major segments of the infrastructure. The rapid increase in population and growth in infrastructure projects are expected to boost the demand for anti-corrosion coatings.

- There are various small-scale projects spread across Asia-Pacific and North America. Apart from being the most populous nation in the world, China also has the largest number of railroad passengers.

- Moreover, road projects in Asia-pacific are also expected to increase the consumption of anti-corrosion coatings. For instance, according to the Ministry of Road Transport and Highways, the ongoing Bharatmala Pariyojna is developing around 26,000 km length of Economic Corridors in order to carry most of the freight traffic on roads. The improvement of Economic Corridors, GQ, and NS-EW Corridoors has been done by building 8.000 km of Inter Corridors and 7,500 km of Feeder Routes.

- For infrastructure development, according to China Briefings, At the end of 2021, China's Ministry of Finance (MoF) pre-allocated USD 229.6 billion of the 2022 quota to be used in the first quarter in the hopes that the extra liquidity would spur investment at the beginning of the year, with higher quotas allocated to provinces and regions with higher capital needs.

- In April 2023, World Bank data stated that private participation in infrastructure (PPI) reached around USD 91.7 billion with around 263 projects, which accounts for 23% growth from 2021. It is observed in low and middle-income countries, the investment in infrastructure has rebounded in 2022.

- According to the US Department of Transportation (USDoT) and Federal Highway Administration (FHWA), in the years 2022 and 2030, around USD 120 billion has been allocated for highways and bridges, of which nearly 2,800 bridges have already been launched. USDOT invested USD 2.2 billion for 166 projects in Rebuilding American Infrastructure with Sustainability and Equity (RAISE) grants. It will facilitate the modernization of rail, ports, roads, bridges, and intermodal transportation to be more affordable, safer, and sustainable.

- The aforementioned factors are expected to increase the demand for anti-corrosion coatings in the forecast period.

Asia-Pacific Region to Dominate the Market

- In Asia-Pacific, though China, Japan, and South Korea lead the shipbuilding industry, new shipping hubs are appearing in Vietnam, India, and the Philippines.

- Australia and New Zealand are both island nations, and the geographical scale of Australia's coastline and waterways has resulted in a large number of recreational, commercial, and defense vessels.

- China is the leading importer and exporter of crude oil in the world. Thus, any changes affecting the expansion activities related to the oil and gas sector are likely to have a significant impact on the anti-corrosion coatings market in China.

- According to US Energy Information Administration, in 2022, China has prioritized low-carbon and carbon-neutral initiatives in order to meet the country's 2030 and 2060 climate targets of peak carbon emissions and carbon neutrality, respectively. The plan has set a goal for natural gas annual production to increase to 8.1 trillion cubic feet (Tcf) and installed generation capacity to increase to 3.0 terawatts (TW).

- Anti-corrosion coatings also play a significant role in infrastructure applications and global development, and an increase in investment in infrastructure is boosting the demand for anti-corrosion coatings. According to the Asian Development Bank (ADB), if Asia- Pacific has to maintain its growth momentum, respond to climate change, and remove poverty, then the region has to invest USD 1.7 trillion per year by 2030 in infrastructure development.

- Thus, the above-mentioned factors are expected to drive the anti-corrosion coatings market in the forecast period.

Anti-Corrosion Coatings Industry Overview

The anti-corrosion coatings market is consolidated and the major companies include PPG Industries, Inc., Akzo Nobel N.V., Nippon Paint Holdings Co., Ltd., RPM International Inc., and the Sherwin-Williams Company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Significant Growth in the Infrastructure Industry

- 4.1.2 Increase in Demand from the Marine Industry

- 4.1.3 Expansion of Oil and Gas Activities in Asia-Pacific and North America

- 4.2 Restraints

- 4.2.1 Government Regulations Related to Volatile Organic Compounds (VOCs)

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Resin Type

- 5.1.1 Epoxy

- 5.1.2 Alkyds

- 5.1.3 Polyester

- 5.1.4 Polyurethane

- 5.1.5 Vinyl Ester

- 5.1.6 Other Resin Types

- 5.2 By Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-borne

- 5.2.3 Powder

- 5.2.4 UV-cured

- 5.3 By End-user Industry

- 5.3.1 Oil and Gas

- 5.3.2 Marine

- 5.3.3 Power

- 5.3.4 Infrastructure

- 5.3.5 Industrial

- 5.3.6 Aerospace and Defense

- 5.3.7 Transportation

- 5.3.8 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East & Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East & Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Axalta Coating Systems, LLC

- 6.4.3 BASF SE

- 6.4.4 H.B. Fuller Company

- 6.4.5 Hempel A/S

- 6.4.6 Jotun

- 6.4.7 Kansai Paint Co.,Ltd

- 6.4.8 Nippon Paint Holdings Co., Ltd.

- 6.4.9 PPG Industries, Inc.

- 6.4.10 RPM International Inc.

- 6.4.11 Sika AG

- 6.4.12 The Sherwin-Williams Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Significant Investments in the Infrastructure Industry in the Emerging Economies

- 7.2 Increased Adoption of Water-borne Coatings

02-2729-4219

+886-2-2729-4219